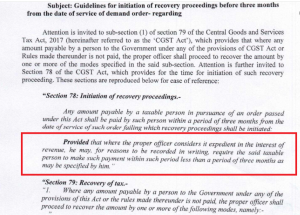

Instruction No. 1 dt 30th May 24 regarding initiation of recovery proceeding before the normal 3 months period from date of service of order!

Proviso to Sec. 78 gives power to proper officer to record reason in writing & ask taxable person for making payment within such period less than 3 months as specified, if it is expedient n interest of revenue.

The Instruction issued by @cbic_indiamentions the following in favour of Taxable Person :-

- Jurisdictional DC/ACTO itself cannot initiate recovery proceedings before the normal period of 3 months in any circumstances. Matter need to placed before Principal Commissioner/ Commissioner.

- PC/C shall examine the reason/justification & if considered expedient in interest of revenue, shall record the reason in writing & ask taxable person make payment in less than 3 months.

- PC/C should provide specific reasons, clearly outlining the reasons for asking taxable person for early payment. Such reasons could include high risk to revenue such as closure of business in near future, impending insolvency etc.

- Reason to believe the apprehension of risk should be based on credible evidences, which may be kept on record.

- Such directions for early payment shall not be issued in MECHANICAL MANNER & to be only issued when interest of revenue to be safeguarded in specific circumstances

Link to Instruction No. 01/2024-GST:- taxinformation.cbic.gov.in/view-pdf/10005

69 comments

Joy November 14, 2014 at 6 43 pm priligy alternative

продать аккаунт купить аккаунт с прокачкой

магазин аккаунтов социальных сетей услуги по продаже аккаунтов

Buy Account Profitable Account Sales

Buy and Sell Accounts Website for Selling Accounts

Sell Account Account exchange

Buy Pre-made Account Sell accounts

Accounts market Buy Pre-made Account

Account Selling Service buyaccounts001.com

account market guaranteed accounts

account trading service account selling platform

account exchange service social media account marketplace

profitable account sales account sale

account buying platform online account store

gaming account marketplace sell account

buy accounts account buying platform

accounts marketplace account marketplace

sell accounts sell accounts

account trading platform gaming account marketplace

buy and sell accounts account trading platform

social media account marketplace social-accounts-marketplace.org

account sale account buying platform

buy account buy accounts

account sale account catalog

account buying platform account exchange service

website for buying accounts account buying platform

secure account sales accounts-store.org

buy accounts website for buying accounts

account trading service https://accounts-offer.org

account trading platform https://accounts-marketplace.xyz

account buying platform accounts market

secure account purchasing platform https://social-accounts-marketplace.xyz/

verified accounts for sale https://buy-accounts.live

account buying service https://social-accounts-marketplace.live/

secure account purchasing platform https://accounts-marketplace-best.pro

маркетплейс аккаунтов akkaunty-na-prodazhu.pro

магазин аккаунтов rynok-akkauntov.top

продать аккаунт купить аккаунт

площадка для продажи аккаунтов akkaunty-market.live

магазин аккаунтов https://akkaunty-optom.live

площадка для продажи аккаунтов https://online-akkaunty-magazin.xyz/

продажа аккаунтов https://kupit-akkaunt.online

buy accounts facebook https://buy-adsaccounts.work/

buy facebook advertising buy facebook profiles

buy a facebook ad account buy facebook account for ads

buy a facebook ad account https://buy-ad-account.click

buy facebook account https://ad-accounts-for-sale.work

buy google ads account https://buy-ads-account.top

buy fb ads account https://buy-accounts.click

buy google agency account buy google ads agency account

buy google ads invoice account buy google ad account

buy google ads account buy google agency account

buy verified google ads account buy google ads verified account

buy old google ads account https://sell-ads-account.click

verified bm https://buy-business-manager.org/

old google ads account for sale https://buy-verified-ads-account.work

buy facebook business manager https://buy-verified-business-manager.org/

buy verified facebook business manager https://business-manager-for-sale.org/

buy facebook verified business account buy-business-manager-verified.org

buy facebook bm https://verified-business-manager-for-sale.org

buy facebook business manager account https://buy-business-manager-accounts.org/

tiktok ad accounts tiktok ad accounts

buy tiktok ad account https://tiktok-ads-account-for-sale.org

buy tiktok ad account https://tiktok-agency-account-for-sale.org

tiktok agency account for sale https://buy-tiktok-ads-accounts.org

Психоаналитик это психотерапевт практикующий психоанализ Консультация может проходить в удобном для вас формате 106

شركة تسليك مجاري بالقطيف

I do not even know the way I ended up right here, but I thought this publish

used to be great. I do not understand who you’re however certainly you are going to a famous

blogger if you happen to are not already. Cheers!

purchase amoxil sale – amoxil generic amoxil drug