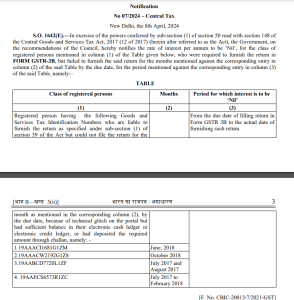

Notification 07/2024 has been issued for Waiver of Interest of specifically 4 companies (all registered in West Bengal) citing that these Registered Person could not file return by due date because of TECHNICAL GLITCH and has sufficient Balance in Cash ledger or has deposited the challan :-

1. 19AAACI1681G1ZM-INDIAN OIL CORPORATION LTD

2. 19AAACW2192G1Z8-WACKER MERROARK CHEMICALS PVT LTD.

3. 19AABCD7720L1ZF-FRESENIUS KABI ONCOLOGY LIMITED

4. 19AAECS6573R1ZC-SAI SULPHONATES PRIVATE LIMITED

POTENTIAL QUERIES/CONCERNS OF REGULAR TAXPAYER [MSME] REGARDING ABOVE

@cbic_india @FinMinIndia @GST_Council

1. Out of more than 1.2 Cr GST dealers,only 4 faced this particular technical Glitch?

2. Till how many days/months did the Technical Glitch prevented filing of return?

3.Has this waiver of Int. issued on direction of High Court or any other judicial Authority?

4. Was there any window provided where Other Registered Dealers facing same issue can apply for relaxation or any Instruction to Jurisdictional Authority regarding relaxation on the same issue?

5. Can 4 Registered Dealers be categorized as ‘Class of Registered Person’ while exercising powers of S.148.

Will it be regarded as Reasonable Classification in terms of Article 14 of Constitution which talks abt EQUALITY?

During COVID-19, relief from Int. was granted based on Turnover Criteria which was a reasonable classification.

6. Will it not be an injustice to all the Tax payers who have sufficient balance in cash ledger but have filed the return with delay or incorrectly ended up paying Interest even when Challan was deposited/Cash ledger had sufficient balance?

Thank you @CAMihirModi for discussion & providing Inputs on this Notification and related aspects 👍

15 comments

Приобретайте актуальную технику вместе с надёжным стабилизатором напряжения

стабилизаторы напряжения http://stabrov.ru.

amoxicillin buy online – combamoxi purchase amoxicillin without prescription

buy diflucan no prescription – diflucan cheap fluconazole 100mg for sale

order cenforce 100mg generic – cenforce 50mg generic buy cenforce 100mg online cheap

tadalafil liquid review – https://ciltadgn.com/# cialis professional review

buy viagra 50 mg – https://strongvpls.com/# sildenafil 100mg blue pill

This is the kind of post I turn up helpful. https://buyfastonl.com/azithromycin.html

I couldn’t weather commenting. Warmly written! buy tamoxifen generic

Greetings! Utter gainful advice within this article! It’s the crumb changes which liking turn the largest changes. Thanks a portion for sharing! https://ursxdol.com/sildenafil-50-mg-in/

The thoroughness in this break down is noteworthy. https://prohnrg.com/product/cytotec-online/

More text pieces like this would create the интернет better.

https://doxycyclinege.com/pro/esomeprazole/

With thanks. Loads of expertise! http://ledyardmachine.com/forum/User-Frjddo

how to buy forxiga – https://janozin.com/# buy forxiga without prescription

xenical usa – on this site orlistat for sale

This is the kind of writing I rightly appreciate. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=493547