TDS to be deducted by Govt./Local Authorities on supplies made by an unregistered person?

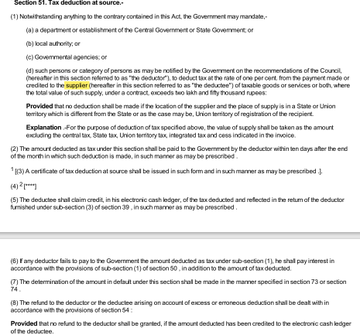

- An Analysis – Nowhere it is mentioned in section 51 that TDS is not to be deducted on supply made by unregistered person. word ‘Supplier‘ has been used and not registered person/taxable person

- No specific rule clarifying the same.

- But When we check form GSTR-7 to be filed by TDS deductor-Field GSTIN of Deductee is mandatory field

- Also in SOP on TDS under GST issued by Law Committee of GST Council, it is mentioned that TDS is not to be deducted when Payment is made to Unregistered Supplier ⇓

- cbic-gst.gov.in/pdf/SOP-TDS-AS

- Only on the basis on last 2 points it is concluded that TDS is not to be deducted on supply from unregistered dealer.

- Concerns to be raised with @cbic_india

- Why Sec 51 or any rule specifically exclude unregistered person. Why the section or rule has not been amended for specifying the same.

- Law & procedure governed through Forms/SOP without clear Legal Binding of Section/Rule is not an ideal scenario.

- Also I would request professionals to check the GST Book/s which you are referring , if you find any explanation is provided regarding this point!!

3 comments

High energy visible light may be both beneficial and dangerous how to take priligy

https://t.me/s/TeleCasino_1x

Gözəl gün!!

Bu linkə keçin – etibarlД± onlayn kazino pulsuz mЙ™rc tЙ™klif

Uğurlar olsun!