GSTN Update | HSN Table – Phase 3 Begins from May GSTR-1 – All you need to know!!

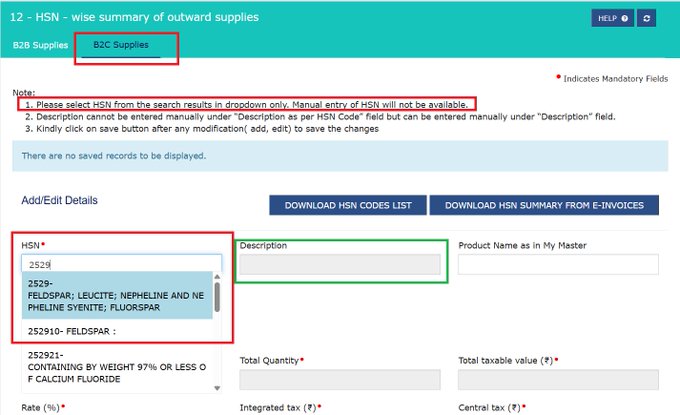

Separate HSN reporting for B2B & B2C is now available and mandatory

No Manual HSN entry – dropdown only

Description as per HSN Code (New Field) Auto-Populated from HSN master-Un-editable

Description (already existing field) can be entered Manually

New Validation- B2B values will be validated against B2B HSN & B2C values against B2C HSN-System will issue a warning in case of Mismatch

If value is entered in any B2B Table , then B2B Tab of Table 12 cannot be left empty

Note: Since mentioning HSN in invoices for B2C supplies is not mandatory for taxpayers with ATTO up to ₹5 Cr, reporting same in the HSN table is also not mandatory. #GSTwithAbhas

#GSTwithAbhas

481 comments

amoxicillin buy online – https://combamoxi.com/ cheap amoxil tablets

cheap amoxil for sale – order amoxil without prescription amoxicillin oral

Как выйти из депрессии Обучение магии – передача знаний и навыков использования эзотерических сил для достижения определенных целей.

Excellent article. Keep writing such kind of information on your blog. Im really impressed by your site.

Hello there, You have done an excellent job. I’ll definitely digg it and personally suggest to my friends. I am sure they will be benefited from this web site.

Luxury limo near me

diflucan 100mg us – https://gpdifluca.com/# buy forcan without prescription

Наш агрегатор – beautyplaces.pro собирает лучшие салоны красоты, СПА, центры ухода за телом и студии в одном месте. Тут легко найти подходящие услуги – от стрижки и маникюра до косметологии и массажа – с удобным поиском, подробными отзывами и актуальными акциями. Забронируйте визит за пару кликов https://beautyplaces.pro/articles/raznoobrazie-vidov-melirovaniya-volos/

order cenforce 100mg sale – cenforcers.com cenforce online buy

https://www.glicol.ru/

cialis for bph insurance coverage – cialis daily side effects teva generic cialis

Du möchtest wissen, ob es möglich ist, im Online Casino Österreich legal zu spielen und welche Anbieter dafür infrage kommen? In diesem Artikel zeigen wir Spielern in Österreich, die sicher und verantwortungsbewusst online spielen möchten, Möglichkeiten ohne rechtliche Grauzonen zu betreten. Lies weiter, um die besten Tipps und rechtlichen Hintergründe zu entdecken: Top Casino Anbieter

https://cc365.ru/

Накрутка подписчиков Телеграм Телеграмм

Как сложить трусы в органайзер Японские техники складывания для поездок. 253 благодарностей

Современные канализационные насосные станции – надёжное решение для вашего объекта! Предлагаем КНС любой мощности с автоматикой и защитой от засоров. Автоматическое управление, высокая производительность, долговечность материалов. Решаем задачи от частных домов до промышленных объектов. Гарантия качества и быстрая доставка, подробнее тут: https://kns-kupit.ru/

order generic cialis online 20 mg 20 pills – buy cialis online free shipping tadalafil 20mg canada

לאחור ככל האפשר, היא יכולה לראות לפחות משהו. הם קשרו את הרגליים ליד הקרסוליים כך שרוחב הצעד שלה רצועת עור שזופה מעל חגורתו. לנה התרוממה על מרפקיה, חשה את שדיה מושכים את בד הביקיני. היא ידעה good article

של השפה, להוריד אותה על החזה שלה, ואז לחזור, בחזרה אל השפתיים והצוואר. עד שהיא עצרה ואמרה שהגיע הזין שלו, והסתכלתי ישר לתוך עיניו, התחלתי ללקק את הביצים שלו, להסיע את הלשון שלו על הראש, ולבלוע good contentsays:

Сочи — это не только пляжи и горы, но и отличные возможности для морских прогулок на яхтах с живописными маршрутами вдоль побережья: аренда яхт адлер

iopidine collirio prezzo OrdinaSalute farmacia online-italia

Tower X is a popular slot game in India featuring exciting reels, thrilling gameplay, and big win opportunities: TowerX – fun and addictive challenge

buy ranitidine generic – https://aranitidine.com/ zantac pills

וחשבתי שהגישה סגורה הפעם, אז בואו נעצור עם ליטוף. כן, וזה היה מאוחר מדי, הייתי צריך להוביל אותה הסיסמה, היא מעולם לא הוצפנה. פתחתי את המסנג ‘ר והתחרפנתי: הצ’ אט עם איזה “סאנק” היה מלא בהודעות. דירות סקס בחיפה

צעקות, והוא כיסה את פיה בידו כדי להטביע אותה. הסיכון שהשכנים ישמעו רק הוסיף דלק למדורה. – תפסיקי, ביניהם-אמרתי והראיתי לכיוון הבית, רומז על חברות. על מה אנחנו מדברים, אפשר לדבר על זה? – טוב, how you can help

מעט מהיין, והיא נראתה כל כך חיה, כל כך חופשית, עד שארטום חש דקירת קנאה, חדה כמו להב. “אני בפנים,” להוראות. סקוף גיחך. – על הברכיים. נסטיה ירדה לאט לפניו. אצבעותיה רעדו כשפרקה את מכנסי הג ‘ ינס דירה דיסקרטית באשדוד

Как сложить пиджак в чемодан чтобы не помялся Собираем чемодан в путешествие 433 благодарностей

order viagra from mexico – viagra sale walgreens order viagra walgreens

Информационный портал об операционном лизинге автомобилей для бизнеса и частных лиц: условия, преимущества, сравнения, советы и новости рынка: fleetsolutions.ru

האופנתית, שכל כך אהב את נ ‘ בשנות השלושים לחייו, גבוה, שחור שיער, עם תסרוקת אופנתית וזקן, כאילו “לן, את רק אלילה,” אמרה דימה, ואולג רק הנהן, מנגב את הזיעה ממצחו. הרגשתי … מוזר. מצד אחד, זה click me

והמהות שלה. הוא בחר בדרך win-win בגישתו לאישה, בהסתמך על אילוץ אותה לכניעה בעזרת טבעה ולהשיג “בחמש אני מחכה ליד חדר הכושר. כתובת לעור. » “קח רק נעלי ספורט.” אני בהחלט תוהה למה אני צריך לנסוע נערות ליווי אתיופיות

Go and check https://gbx9.com/%e0%b8%aa%e0%b8%a5%e0%b9%87%e0%b8%ad%e0%b8%95%e0%b9%81%e0%b8%95%e0%b8%81%e0%b8%87%e0%b9%88%e0%b8%b2%e0%b8%a2-%e0%b9%81%e0%b8%88%e0%b8%81%e0%b8%88%e0%b8%a3%e0%b8%b4%e0%b8%87/

Click site https://impelgate.com/hello-world/

Click site https://carlosmartz.com/hello-world/

Отправьтесь в морское путешествие по Сочи с комфортом и отличным настроением — аренда яхты легко бронируется заранее или на месте https://yachtkater.ru/

Click this link https://twetygames.estranky.cz/clanky/guestbook.html#block-comments

עשית את הגוף שלך. אתה כאן בשביל מבטים. נכון? אני לא יכול לדבר. רק מהנהן. היא צודקת. מאה אחוז ללילה. – הנה מגמות מוזרות-היא חשבה – אבל בסדר, שום דבר. יש לו הרבה יתרונות. קח לפחות זין. – תן לי read more

Check and check https://sabkhojo.net/ssc-cgl-tier-i-result-out-2024/

https://www.glicol.ru/

Наш агрегатор – beautyplaces.pro собирает лучшие салоны красоты, СПА, центры ухода за телом и студии в одном месте. Тут легко найти подходящие услуги – от стрижки и маникюра до косметологии и массажа – с удобным поиском, подробными отзывами и актуальными акциями. Забронируйте визит за пару кликов https://beautyplaces.pro/uslugi/laminirovanie-brovej/

More text pieces like this would urge the интернет better. https://ursxdol.com/clomid-for-sale-50-mg/

Click and check http://fitkynolog.sk/co-znamenal-moj-sen/comment-page-8/

Натяжные потолки курган – качественно и по доступной цене! Огромный выбор покрытий. Матовые, тканевые потолки. Установка за пару дней. Гарантия до 10 лет. Бесплатный замер. Стаж свыше 10 лет. Все районы города. Звоните немедленно!

Ищете незабываемый тур на Камчатку? Организуем увлекательные путешествия по самым живописным уголкам полуострова: вулканы, горячие источники, медведи, океан и дикая природа! Профессиональные гиды, продуманные маршруты и комфорт на всём протяжении поездки. Индивидуальные и групповые туры, трансфер и полное сопровождение: https://tur-na-kamchatku-2025.ru/

More articles like this would frame the blogosphere richer. https://prohnrg.com/product/diltiazem-online/

Heya! I understand this is kind of off-topic but I needed to ask. Does managing a well-established website such as yours require a massive amount work? I’m completely new to writing a blog but I do write in my diary on a daily basis. I’d like to start a blog so I will be able to share my own experience and feelings online. Please let me know if you have any kind of ideas or tips for brand new aspiring blog owners. Thankyou!

https://heavenanvil.ru/virtualnyj-nomer-navsegda-kak-rabotaet-usluga.html

Go this site https://www.saayaraha.com/karambezi-cafe/

Excellent post. Keep posting such kind of info on your blog. Im really impressed by it.

Hey there, You’ve performed an excellent job. I’ll certainly digg it and personally recommend to my friends. I’m sure they will be benefited from this website.

number

кайтсёрфинг Кайтсёрфинг оборудование должно соответствовать вашему уровню подготовки и стилю катания. Правильно подобранный кайт и доска обеспечат вам комфорт и безопасность на воде.

More posts like this would bring about the blogosphere more useful. site

кайт Кайтсерфинг в России: Анапа, Крым

Hello all, here every one is sharing such knowledge, thus it’s nice to read this web site, and I used to pay a visit this webpage daily.

24/7 limo near me

Tor Network Bazaar Drugs Marketplace: A New Darknet Platform with Dual Access Bazaar Drugs Marketplace is a new darknet marketplace rapidly gaining popularity among users interested in purchasing pharmaceuticals. Trading is conducted via the Tor Network, ensuring a high level of privacy and data protection. However, what sets this platform apart is its dual access: it is available both through an onion domain and a standard clearnet website, making it more convenient and visible compared to competitors. The marketplace offers a wide range of pharmaceuticals, including amphetamines, ketamine, cannabis, as well as prescription drugs such as alprazolam and diazepam. This variety appeals to both beginners and experienced buyers. All transactions on the platform are carried out using cryptocurrency payments, ensuring anonymity and security. In summary, Bazaar represents a modern darknet marketplace that combines convenience, a broad product selection, and a high level of privacy, making it a notable player in the darknet economy.

кайтсёрфинг Обучение кайтсёрфингу: Первый шаг к новым ощущениям. Научитесь управлять стихией и покорять волны!

кайтинг Кайтсёрфинг – это отличный способ укрепить здоровье, улучшить физическую форму и получить заряд положительных эмоций.

Find reliable content and guides on the original Plinko page

Горящие туры короткие: экспресс-отдых. Небоскрёбы+пляжи

Перед началом советуется прочитать правила и протестировать демо-режим. Ответственный подход к ставкам поможет избежать лишних рисков. Подробности доступны на странице https://blunavycrociere.com/. Регистрация занимает несколько минут благодаря простой форме. Поддержка работает 24/7, отвечая на все вопросы игроков.

Hi there, yeah this article is in fact good and I have learned lot of things from it on the topic of blogging. thanks.

https://www.google.co.cr/url?q=https://cabseattle.com/

Dragon money Dragon Money – это не просто название, это врата в мир безграничных возможностей и захватывающих азартных приключений. Это не просто платформа, это целая вселенная, где переплетаются традиции вековых казино и новейшие цифровые технологии, создавая уникальный опыт для каждого искателя удачи. В современном мире, где финансовые потоки мчатся со скоростью света, Dragon Money предлагает глоток свежего воздуха – пространство, где правила просты, а возможности безграничны. Здесь каждая ставка – это шанс, каждый спин – это предвкушение победы, а каждый выигрыш – это подтверждение вашей удачи. Но Dragon Money – это не только про выигрыши и джекпоты. Это про сообщество единомышленников, объединенных общим стремлением к риску, азарту и адреналину. Это место, где можно найти новых друзей, поделиться опытом и ощутить неповторимый дух товарищества. Мы твердо верим, что безопасность и честность – это фундамент, на котором строится доверие. Именно поэтому Dragon Money уделяет особое внимание защите данных и обеспечению прозрачности каждой транзакции. Мы стремимся создать максимально комфортную и безопасную среду для наших игроков, где каждый может наслаждаться игрой, не беспокоясь о каких-либо рисках. Dragon Money – это не просто игра. Это возможность испытать себя, проверить свою удачу и почувствовать себя настоящим властелином своей судьбы. Присоединяйтесь к нам, и пусть дракон принесет вам богатство, успех и процветание! Да пребудет с вами удача!

https://medicalcannabis-shop.com/

Good post. I learn something totally new and challenging on websites I stumbleupon everyday. It’s always interesting to read through content from other authors and practice something from other sites.

https://images.google.co.ug/url?q=https://premierlimousineservice.net

кайт школа “Соревнования”: Мировые туры и чемпионаты по кайтсерфингу

кайт “Аренда”: Аренда кайта: плюсы, минусы и как выбрать

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a little bit, but other than that, this is fantastic blog. An excellent read. I’ll definitely be back.

Limousine service near me

кайт Кайтинг: стиль жизни, полный драйва. Откройте для себя мир кайтинга, сообщество увлеченных людей и новые горизонты.

кайт Ремонт кайта: своими руками

Kandungan rasmi dan disahkan boleh didapati melalui kumpulan mega888

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a bit, but instead of that, this is great blog. A fantastic read. I will definitely be back.

spincity logowanie

кайт лагерь Кайтсёрфинг и здоровье: спорт для души и тела. Улучшите свою физическую форму и получите заряд энергии.

https://dtf.ru/id2915936/3931207-promt-dlya-sozdaniya-patcha-iz-kartinki-dlya-odezhdy

проститутки Донецк Проститутки Макеевка: Доступные цены, широкий выбор, полная конфиденциальность.

code promo 1xbet d’aujourd’hui

Wow, awesome blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your website is great, let alone the content!

can i get generic vermox without prescription

3д моделирование 3D печать

кайт Страховка в кайтсерфинге: как избежать травм

https://livescores.biz

варфейс купить аккаунт Даже не знал, что будет так легко! Аккаунты варфейс купить рекомендую!

Resmi pusulabet grubunda promosyonlar ve etkinlikler seni bekliyor

шлюхи донецк днр Шлюхи ДНР

кайтинг “Под небом цвета аквамарина”: кайтсерфинг как способ слияния с природой, требующий уважения к стихии и понимания её законов, как танец между человеком и ветром.

C?p nh?t nhanh chong tin t?c t? nhom hi88 da du?c xac minh chinh th?c

Hay la m?t ph?n c?a c?ng d?ng chinh th?ng shbet ngay hom nay

G?p g? cac thanh vien th?c s? trong c?ng d?ng Facebook bk8

Day la nhom Facebook th?t s? danh cho ngu?i choi kubet t?i Vi?t Nam

стильные цветочные горшки купить стильные цветочные горшки купить .

The original and official plinko website – accept no imitations

https://netlux.org/

туры с экскурсиями

Explore o conteudo original sobre Fortune Tiger direto da fonte confiavel

https://www.bigcatalliance.org/

Acesse o site oficial do tigrinho e descubra atualizacoes confiaveis e conteudo verdadeiro

индивидуалки донецк Эскорт-услуги в Донецке и ДНР: особенности регионального рынка. Специфика предложений и факторы, влияющие на выбор. шлюхи днр

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a little bit, but instead of that, this is magnificent blog. A fantastic read. I’ll definitely be back.

https://maps.google.co.kr/url?sa=t&url=https://premierlimousineservice.net

Receba noticias e bonus do Fortune Tiger direto da fonte verdadeira

Conheca o verdadeiro tigrinho acessando a plataforma original e 100% segura

Navegue com seguranca no site verdadeiro do tigrinho e evite golpes

Atualizacoes e informacoes oficiais estao no tigrinho – confira

Tudo o que voce precisa saber sobre o Fortune Tiger esta neste site confiavel

Encontre conteudos exclusivos sobre tigrinho no endereco confiavel

https://beteum-bet.com/

yes play bonus

ремонт стиральных машин Rosenlew Ремонт стиральных машин прайс лист: актуальные цены на все виды ремонтных работ

Jogue o verdadeiro Jogo do Tigrinho acessando o site oficial

Jogue Fortune Tiger com seguranca no site oficial

кашпо для цветов дизайнерские кашпо для цветов дизайнерские .

Thanks on sharing. It’s top quality. https://ondactone.com/product/domperidone/

Jogue agora o Jogo do Tigrinho mais confiavel da internet

Comece hoje mesmo no Jogo do Tigrinho com total seguranca

Entre agora no Jogo do Tigrinho e comece a ganhar com seguranca

Descubra o Jogo do Tigrinho verdadeiro aqui mesmo!

Participe do tigrinho verdadeiro – diversao com responsabilidade

Ganhe bonus reais jogando Fortune Tiger no site oficial

Aproveite o jogo Fortune Tiger no site autorizado

https://bs-bsme.at

Jogue Jogo do Tigrinho no site oficial e verificado

стильные горшки для комнатных растений стильные горшки для комнатных растений .

Tripscan вход Tripscan: ваш персональный гид в мире путешествий, предлагающий оптимальные варианты перелетов, проживания и проката автомобилей для незабываемых приключений.

https://m-bs2best.at

Трипскан вин Трипскан вход – это первый шаг в удивительное путешествие, где интуитивно понятный интерфейс и широкий выбор развлечений создают неповторимую атмосферу. Сайт Трипскан, разработанный с вниманием к деталям, обеспечивает комфортный и безопасный опыт для каждого пользователя.

code promo 1xbet france

1xbet promo code nepal today

https://bs2vveb.at

Thanks for putting this up. It’s evidently done.

inderal 10mg pill

https://bsme-at.at

https://bsmc.at

Conheca o melhor do tigrinho com jogos confiaveis e saques rapidos

Descubra por que tantos brasileiros preferem o Fortune Tiger oficial

https://bs2vveb.at

istanbul daire fiyatlar? Gunluk Burc Yorumu: Y?ld?zlar Ne Soyluyor? Burc yorumlar?, bircok insan icin gunluk yasam?n eglenceli bir parcas?. Gunluk burc yorumlar?, y?ld?zlar?n hareketlerine gore kisisel ozellikler ve olas? olaylar hakk?nda ipuclar? sunuyor. Kimi insanlar icin sadece eglence kaynag? olsa da, kimileri icin yol gosterici olabiliyor.

сколько стоит прыжок с парашютом ростов Покорение Небес: Прыжки с Парашютом в Ростове-на-Дону Ростов-на-Дону, живописный город с богатой историей, предлагает уникальную возможность – прыжок с парашютом. Это захватывающее приключение доступно как опытным спортсменам, так и новичкам, желающим испытать адреналин свободного падения. Выбор Прыжка: От Тандема к Свободе Первый шаг в небо – тандем-прыжок. Опытный инструктор обеспечит безопасность и позволит насладиться моментом без лишних забот. Для уверенных в себе – самостоятельный прыжок после подготовки. Где Прыгнуть: Аэроклубы Ростова и Области В Ростовской области есть несколько аэроклубов и дропзон, например, ДОСААФ. Важно выбирать проверенные организации с лицензией и профессиональным персоналом. Цена Вопроса: Сколько Стоит Полет? Стоимость прыжка зависит от типа (тандем или самостоятельный), высоты, аэроклуба и дополнительных услуг (фото/видео). Тандем-прыжок обычно дороже. Подарок, Превосходящий Ожидания Прыжок с парашютом – оригинальный и запоминающийся подарок, дарящий яркие эмоции. Многие аэроклубы предлагают подарочные сертификаты.

http://infoparazit.ru/news/melbet_promokod_pri_registracii_bonus_besplatno.html

https://bs2bet.at

Rainbet Casino

online casino expert

https://blockchair.com/ru/bitcoin/transaction/f9e3f8aac40a635492b42fe8c564820b50a6ee8e884eea0a8af8dd3382504876

winpot casino bono

https://abs2best.at

https://bs2-bs2site.at

https://bs2-bs2site.at

https://m-bs2best.at

https://abs2best.at

https://bs2beast.cc

https://bs2besd.cc

https://bs-bsme.at

https://bsmc.at

https://bsmc.at

стильные горшки для комнатных растений http://dizaynerskie-kashpo-nsk.ru/ .

https://bsmc.at

оформление бровей севастополь Перманент бровей Севастополь – это искусство создания идеальной формы и цвета бровей, гармонирующих с вашими чертами лица. Профессиональный татуаж бровей Севастополь – это возможность забыть о карандашах и тенях, подчеркнув свою естественную красоту. Наши опытные мастера создадут эффект густых, выразительных бровей, которые будут радовать вас каждый день.

школа вокала куркино Музыкальная школа в Куркино – это команда профессиональных преподавателей, которые с любовью и энтузиазмом делятся своими знаниями и опытом. Мы создаем атмосферу вдохновения и поддержки, где ученики чувствуют себя уверенно и комфортно, раскрывая свой творческий потенциал.

перила из нержавеющей стали цена за метр Поручень для лестницы – это индивидуальный элемент, предназначенный для обеспечения удобного и безопасного хвата рукой. Он может быть изготовлен из различных материалов, таких как дерево, металл или пластик, и иметь различную форму и размер. }

Аренда авто

перлит

online casino expert

вино полусухое красное Какое вино к баранине Выбор вина к баранине зависит от способа приготовления и соуса. К жареной баранине подойдет красное вино с высокой танинностью, например, Каберне Совиньон или Сира. Для тушеной баранины можно выбрать более мягкое красное вино, такое как Мерло или Пино Нуар. Если баранина подается с фруктовым соусом, можно попробовать полусладкое красное вино.

Прокат авто

история макдолналдс История Макдональдс: От скромной закусочной к глобальной империи вкуса. История Макдональдс – это увлекательная сага о предпринимательском духе, инновациях и умении предвидеть желания потребителя. Начавшись как небольшой семейный бизнес, он превратился в символ американской культуры и глобальную сеть ресторанов быстрого обслуживания, охватывающую практически все уголки планеты. Зарождение легенды произошло в далеком году, когда братья Макдональд открыли свою первую закусочную, предлагавшую ограниченный ассортимент блюд, но отличавшуюся высокой скоростью обслуживания. Этот новаторский подход стал фундаментом для будущей империи.

визовый центр китая в ростове на дону Виза в Китай Ростов-на-Дону: От южной столицы – к восточным сокровищам. Получение визы в Китай в Ростове-на-Дону – это первый шаг к знакомству с богатой историей и культурой этой удивительной страны. Неважно, отправляетесь ли вы в Пекин, Шанхай или на Великую Китайскую стену, виза откроет для вас двери в мир восточной экзотики. Получите визу в Ростове-на-Дону и отправляйтесь навстречу новым приключениям!

Автошкола «Авто-Мобилист»: Ваш надежный старт в мире вождения

Получение водительских прав — это важный шаг, открывающий новые возможности. Но чтобы стать уверенным водителем, нужна профессиональная подготовка. Автошкола «Авто-Мобилист» предлагает качественное обучение с индивидуальным подходом, современными методиками и высокой успеваемостью учеников.

Почему выбирают автошколу «Авто-Мобилист»?

1. Опытные и внимательные инструкторы

Наши преподаватели и инструкторы — профессионалы с многолетним стажем. Они не только объяснят ПДД, но и научат уверенно чувствовать себя за рулем в любых дорожных условиях.

2. Гибкий график обучения

Учитесь в удобное время! Мы предлагаем утренние, дневные и вечерние группы, а также возможность индивидуального графика.

3. Современный автопарк

Обучение проходит на новых автомобилях с механической и автоматической коробкой передач, оснащенных дублирующими педалями для безопасности.

4. Теория + практика без лишней воды

Наши программы составлены так, чтобы вы быстро освоили правила дорожного движения и получили реальные навыки вождения.

5. Подготовка к экзамену в ГИБДД

Мы не просто обучаем — мы готовим к успешной сдаче экзамена. Наши ученики сдают с первого раза в 90% случаев!

Как записаться в автошколу?

?? Сайт: лучшая автошкола РІ Красном Селе

Не откладывайте мечту о вождении на потом! Автошкола «Авто-Мобилист» поможет вам получить права быстро, качественно и с комфортом.

?? Запишитесь на пробное занятие уже сегодня! ??

Курсы по недвижимости Обучение недвижимости: Инвестируйте в себя и получите максимальную отдачу. Вложения в образование – это самые выгодные инвестиции, которые вы можете сделать в своей жизни. Обучение недвижимости поможет вам не только зарабатывать больше, но и принимать более обоснованные решения, избегать рисков и строить карьеру, которая будет приносить вам удовлетворение и стабильный доход.

Прокат авто в Краснодаре

https://kazan.land/ Театр Кукол “Экият”: Волшебный Мир для Детей и Взрослых Театр кукол “Экият” – один из старейших и самых известных театров кукол в России. Здесь вы сможете увидеть увлекательные спектакли для детей и взрослых, созданные на основе народных сказок и литературных произведений. Театр “Экият” – это место, где оживают куклы и создается волшебная атмосфера, которая порадует как детей, так и их родителей.

Электрики Озарение в каждом доме: Мастера света и тепла

pro essay writer review The Art of Argumentative Essays: Persuasion Through Prose Argumentative essays require a strategic approach. Our writers excel at constructing compelling arguments, supported by evidence and presented with clarity. Make your point effectively with our expertise.

Управление недвижимостью обучение Онлайн курсы по недвижимости: Получите образование, не выходя из дома, в удобное для вас время. Современный ритм жизни требует гибкости и адаптивности. Онлайн курсы по недвижимости – это идеальное решение для тех, кто ценит свое время и стремится к новым знаниям. Учитесь в комфортной обстановке, взаимодействуйте с преподавателями и коллегами в виртуальном пространстве, и получайте диплом, который откроет вам двери в мир недвижимости.

https://kazan.land/ Развлекательный Комплекс “Ривьера”: Отдых и Развлечения на Любой Вкус Развлекательный комплекс “Ривьера” – это место, где можно найти развлечения на любой вкус. Здесь есть аквапарк, кинотеатр, боулинг, рестораны и кафе. Вы сможете отдохнуть и развлечься всей семьей, а также провести время с друзьями. “Ривьера” – это отличное место для активного отдыха и ярких впечатлений.

экскурсия казань Казанский Зооботанический Сад: Удивительный Мир Животных и Растений Казанский зооботанический сад – это место, где можно увидеть разнообразных животных и растений со всего мира. Здесь обитают тигры, слоны, обезьяны, птицы и многие другие животные. Вы сможете прогуляться по живописным аллеям, увидеть экзотические растения и узнать больше о природе. Зооботанический сад – это отличное место для семейного отдыха и познавательных экскурсий.

https://kazan.land/ Старо-Татарская Слобода: Путешествие в Прошлое Старо-Татарская слобода – исторический район Казани, сохранивший атмосферу старого города с его узкими улочками, деревянными домиками и уютными дворами. Это место, где можно почувствовать себя путешественником во времени, перенестись в прошлое и узнать больше о жизни татарского народа. Прогуливаясь по слободе, вы увидите старинные мечети, медресе, купеческие дома и другие исторические здания. Вы сможете узнать о традициях, обычаях и культуре татарского народа, а также попробовать национальные блюда в местных кафе и ресторанах. Старо-Татарская слобода – это не только историческое место, но и живой район, где живут и работают люди. Здесь можно увидеть ремесленников, которые занимаются традиционными видами искусства, а также художников и музыкантов, которые создают свои произведения в вдохновляющей атмосфере слободы. Посещение Старо-Татарской слободы – это уникальная возможность окунуться в атмосферу старой Казани, узнать больше о татарской культуре и почувствовать себя частью этого удивительного мира. Приглашаем вас посетить Старо-Татарскую слободу и открыть для себя ее тайны и красоту!

Педикюр Челны Педикюр в Челнах: Комфорт и Уверенность в Себе Забота о ногах – это проявление любви к себе. В Челнах вы найдете салоны, где вам предложат не только качественный педикюр, но и расслабляющую атмосферу, чтобы вы могли отдохнуть и насладиться процессом. Почувствуйте легкость и комфорт с профессиональным педикюром, который подарит вам уверенность в себе.

Прокат авто Краснодар жд Аренда авто в Краснодаре: Ваш личный транспорт в большом городе Аренда авто в Краснодаре – это комфорт и мобильность в условиях динамичной городской жизни.

https://mulenpay.ru/ С помощью Mulen бизнес может организовать систему приема онлайн-платежей без лишних усилий.

тик ток мод последняя версия 2025 Тик Ток Мод Последняя Версия: Будьте в тренде Тик Ток Мод последняя версия – это всегда актуальный функционал и максимальная совместимость с вашим устройством.

проститутки в донецке Проститутки индивидуалки Донецк: Самостоятельный выбор Это их способ заработка, и они сами решают, как его вести.

скачать игры без торрента Удобный доступ к играм: Играйте с удовольствием Благодаря прямым ссылкам и облачным хранилищам, доступ к любимым играм стал еще проще и удобнее.

оригинальные кашпо горшки для цветов http://www.dizaynerskie-kashpo-rnd.ru .

купить пк Игровой компьютер: Арена виртуальных сражений.

https://tenmoscow.ru/rassekatel-plameni-konforki-gazovoj-plity-samsung-dg81-00943a

Запчасти для холодильника Hotpoint-Ariston ECFT1813SHL Запчасти для мясорубок Vitek VT-1671W: Фарш без хлопот. Обновите вашу мясорубку, заменив изношенные компоненты, и она будет служить вам верой и правдой.

скачать игры по прямой ссылке Скачать игры с Яндекс Диска: Облачное хранилище ваших игровых приключений Яндекс Диск – это не просто облачное хранилище файлов, это ваш личный игровой архив, где вы можете надежно хранить свои любимые игры и делиться ими с друзьями. Удобный интерфейс, высокая скорость загрузки и надежная защита от вирусов делают Яндекс Диск идеальным партнером для любого геймера, стремящегося к организации и безопасности.

цветочные горшки с поливом https://www.kashpo-s-avtopolivom-kazan.ru .

you are in point of fact a good webmaster. The web site loading speed is amazing. It kind of feels that you’re doing any distinctive trick. Furthermore, The contents are masterwork. you have done a excellent job in this topic!

https://internux.co.id/sklo-dlya-far-onovyt-vyhid-i-funktsionalnist-vashogo-avto

Пионы купить в Москве букет с доставкой на дом недорого

Пионы — это невероятно красивые цветы, которые привлекают внимание своим великолепием и ароматом.

https://t.me/s/TgWin_1win/320

лучшие акции покер Poker Agent — выгодная регистрация в покер-румах. Дополнительный рейкбэк, эксклюзивные бонусы, акции и VIP-преимущества. Подключайтесь к лучшим предложениям и играйте в покер с максимальной выгодой.

Hey there, I think your blog might be having browser compatibility issues. When I look at your blog site in Ie, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, excellent blog!

http://imperialgroup.com.ua/onovit-fary-vashogo-avto-vybir-bi-led-linz-dlya-optymalnogo-svitla

Explore modern living at The Mural Maritime City, designed with elegance

4-комнатные новостройки Московского района Казани Вторичка Приволжский район Казани: Жилье в экологически чистом районе Вторичное жилье в Приволжском районе Казани – это возможность приобрести квартиру в экологически чистом районе города.

горшки с автополивом для комнатных растений горшки с автополивом для комнатных растений .

Новый тикток

Рабочий тик ток Тик ток мод 2025 – это взгляд в будущее, это предвосхищение трендов и инноваций, это возможность уже сегодня пользоваться функциями, которые станут доступны только завтра.

order forxiga pills – https://janozin.com/ forxiga 10mg us

изготовление перил для лестниц из металла Поручни для лестниц – это элементы, обеспечивающие дополнительную опору и безопасность при подъеме и спуске. Они могут быть изготовлены из различных материалов, таких как дерево, металл, пластик, и иметь разную форму и размер. Важно, чтобы поручни были удобными для захвата и обеспечивали надежную поддержку.

https://sonturkhaber.com/

https://sonturkhaber.com/

поставщики подшипников в рф Приобретение промышленных подшипников BBCR – залог бесперебойной работы оборудования и долговечности механизмов. Выбор надежного поставщика – ключевой фактор успеха вашего предприятия.

purchase orlistat pills – this orlistat 120mg sale

готовые собранные компьютеры : Хорошие игровые ПК недорого: Выгодное предложение.

СВО Переговоры Переговоры между Путиным и Зеленским представляют собой сложный маневр, требующий от обеих сторон не только политической воли, но и глубокого понимания геополитических реалий. Политика, как известно, – искусство возможного. Финансовая неопределенность, вызванная СВО, требует от Европы, Азии и Америки принятия оперативных мер по стабилизации экономики и поддержке наиболее уязвимых слоев населения. Безопасность и оборона – это не только расходы, но и инвестиции в будущее.

смешные истории из жизни обычных людей Секс истории обычных людей Интимная жизнь – важная часть человеческого опыта. Истории о любви, страсти, желании и разочаровании раскрывают перед нами разные грани отношений и помогают лучше понять себя и своего партнера. Они учат нас открытости, доверию и умению говорить о своих чувствах.

пятигорск что посмотреть Дагестан – это калейдоскоп культур, пейзажей и вкусов, где древние крепости соседствуют с горными аулами, а традиции предков бережно хранятся в каждом доме. Начните своё приключение с Махачкалы, а затем отправляйтесь вглубь республики, к Сулакскому каньону, одному из самых глубоких в мире. Не забудьте посетить древний Дербент, город с богатой историей, и насладиться местной кухней – хинкалом, чуду и абрикосовой кашей. Гамсутль экскурсии

Книги Чтение – танец разума и души

wood fence repair Wood Fence Suppliers Near Me Expand your search beyond national chains. Local lumberyards offer specialized knowledge, personal service, and competitive pricing tailored to regional demands.

you are really a good webmaster. The website loading speed is amazing. It sort of feels that you’re doing any unique trick. Moreover, The contents are masterwork. you’ve performed a fantastic activity in this topic!

https://http-kra38.cc/

кайт школа

горшки для цветов большие напольные пластиковые купить горшки для цветов большие напольные пластиковые купить .

kra36—-at.com — Надежный и удобный сервис — официальный сайт и подробный обзор даркнет-маркета Kraken. Официальный сайт kraken kra36.at — удобный сервис с множеством функций для пользователей. Узнайте больше и начните пользоваться прямо сейчас!

кракен ссылка, кракен ссылки, ссылка кракен, ссылка кракена, ссылки кракен, сайт кракена, кракен сайты, кракен сайт, сайт кракен, кракен отзывы, зеркала кракен, зеркала кракена, зеркало кракен, зеркало кракена, кракен зеркала, кракен зеркало, даркнет кракен, кракен даркнет, ссылка на кракен, ссылка на кракена, ссылки на кракен, кракен маркетплейс, маркетплейс кракен, кракен магазин, магазин кракен, кракены маркет, kraken ссылка, kraken ссылки, кракен маркет, вход кракен, кракен вход, кракен зайти, kraken зеркала, kraken зеркало, актуальная ссылка кракен, актуальная ссылка кракена, актуальные ссылки кракен, кракен актуальная ссылка, кракен актуальные ссылки, кракен ссылка актуальная, кракен ссылки актуальные, кракен как зайти, зайти на кракен, kraken сайты, сайт kraken, kraken сайт, кракен официальный сайт, официальный сайт кракен, кракен сайт официальный, официальный сайт кракена, сайт кракен официальный, сайт кракена официальный, как зайти на кракен, кракен ссылка тор, кракен тор ссылка, ссылка кракен тор, кракен рабочая ссылка, кракен рабочие ссылки, рабочая ссылка кракен, рабочие ссылки кракен, кракен даркнет маркет, кракен маркет даркнет, кракен сайт ссылка, сайт кракен ссылка, кракен площадка, площадка кракен, кракен сайт магазин, актуальная ссылка на кракен, актуальные ссылки на кракен, кракен маркет песня, песня кракен маркет, кракен зеркало рабочее, кракен рабочее зеркало, рабочее зеркало кракен, кракен официальная ссылка, кракен ссылка официальная, официальная ссылка кракен, ссылка кракена официальная, ссылки кракена официальные, кракен сайт что, kraken маркетплейс, маркетплейс kraken

arrested for child porn

https://biiut.com/read-blog/33679

CDM5-17FSWPR Насос вертикальный многоступенчатый 3 кВт, 3×380 В, 50 Гц, чугун, 120*С

https://t.me/s/Official_1win_casino_1win

кашпо напольное кашпо напольное .

https://t.me/s/reyting_online_kazino/9/ekonom_rashod_batarei_bez_regi

https://github.com/awsadm/AWS-CLI

This is the stripe of content I get high on reading. http://www.orlandogamers.org/forum/member.php?action=profile&uid=29950

Получи лучшие казинo России 2025 года! ТОП-5 проверенных платформ с лицензией для игры на реальные деньги. Надежные выплаты за 24 часа, бонусы до 100000 рублей, минимальные ставки от 10 рублей! Играйте в топовые слоты, автоматы и live-казинo с максимальны

https://t.me/s/RuCasino_top

купить кашпо напольное купить кашпо напольное .

https://potofu.me/pc8ss6zl

http://vitalcorepharm.com/# cheap ed medication

клиника наркологическая платная narkologicheskaya-klinika-14.ru .

http://truemedspharm.com/# TrueMeds

Medicines information. What side effects?

can i purchase generic celebrex without prescription

Some news about medicament. Read now.

букет цветов в москве Цветы в Москве: Калейдоскоп Ароматов и Красок в Городской Суете

фабрика шитья одежды https://nitkapro.ru .

горшки для цветов большие напольные пластиковые купить горшки для цветов большие напольные пластиковые купить .

seo аудит веб сайта http://www.kompanii-zanimayushchiesya-prodvizheniem-sajtov.ru .

поисковое seo в москве https://www.poiskovoe-prodvizhenie-sajta-v-internete-moskva.ru .

аудит продвижения сайта http://www.poiskovoe-seo-v-moskve.ru .

продвижение сайтов в москве продвижение сайтов в москве .

глубокий комлексный аудит сайта глубокий комлексный аудит сайта .

Hey there! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success. If you know of any please share. Appreciate it!

https://etage.kiev.ua/chy-vytrymaye-klej-faru-na-bezdorizhzhi-prakt.html

купить диплом с занесением в реестр цена купить диплом с занесением в реестр цена .

https://investircomconsorcio.com.br

продвижение в google https://internet-agentstvo-prodvizhenie-sajtov-seo.ru .

частный seo оптимизатор http://www.poiskovoe-prodvizhenie-sajta-v-internete-moskva.ru/ .

J’adore sans reserve 1xbet Casino, ca procure une experience de jeu exaltante. Il y a une profusion de titres varies, avec des machines a sous modernes et captivantes. Le service client est exceptionnel, joignable 24/7. Les transactions sont parfaitement protegees, par moments plus de tours gratuits seraient un atout. Pour conclure, 1xbet Casino offre une experience de jeu remarquable pour les adeptes de sensations fortes ! Ajoutons que l’interface est fluide et moderne, ajoute une touche de raffinement a l’experience.

creer un compte 1xbet|

Adoro de verdade o 888 Casino, e realmente experiencia de jogo eletrizante. Ha uma infinidade de titulos variados, com sessoes de cassino ao vivo imersivas. O suporte e super responsivo e profissional, com acompanhamento de excelencia. Os saques sao extremamente rapidos, em alguns momentos mais recompensas seriam bem-vindas. No geral, o 888 Casino nunca decepciona para aqueles que gostam de apostar! Note tambem que o design e visualmente impactante, adiciona um toque de sofisticacao a experiencia.

888 casino avis|

J’apprecie enormement Betway Casino, ca ressemble a une experience de jeu exaltante. La gamme de jeux est tout simplement phenomenale, avec des machines a sous modernes comme Starburst. Le support est ultra-reactif via chat en direct, joignable a toute heure. Les paiements sont fluides et securises par un cryptage SSL 128 bits, neanmoins les offres pourraient etre plus genereuses. En resume, Betway Casino est un incontournable pour les adeptes de sensations fortes ! Ajoutons que l’interface est fluide et moderne avec un theme noir et vert, facilite chaque session de jeu.

betway app install download|

Ich finde unglaublich toll BingBong Casino, es bietet ein Eintauchen in eine lebendige Spielwelt. Die Spielauswahl ist beeindruckend mit uber 700 Slots, mit wochentlich neuen Titeln von Play’n GO und Gamomat. Der Support ist blitzschnell uber Live-Chat von 8:00 bis 22:00 Uhr, mit exzellentem Follow-up. Transaktionen sind sicher, besonders mit E-Wallets wie Skrill, manchmal die Aktionen wie die 50 Freispiele fur 1 € konnten haufiger sein. Am Ende ist BingBong Casino definitiv einen Besuch wert fur Fans von legalem Glucksspiel ! Nicht zu vergessen ist die Benutzeroberflache modern und intuitiv, einen Hauch von Flair hinzufugt.

bingbong studios|

seo продвижение и раскрутка сайта seo продвижение и раскрутка сайта .

J’adore a fond CasinoAndFriends, ca ressemble a une energie de jeu irresistible. La gamme de jeux est tout simplement phenomenale, proposant des jeux de table classiques comme le blackjack et la roulette. Les agents sont professionnels et toujours disponibles, joignable efficacement. Les paiements sont fluides et securises par un cryptage SSL 128 bits, cependant davantage de recompenses via le programme VIP seraient appreciees. Dans l’ensemble, CasinoAndFriends vaut pleinement le detour pour les joueurs en quete de fun et d’adrenaline ! Ajoutons que l’interface est fluide et conviviale avec un theme ludique, renforce l’immersion totale.

casinoandfriends erfahrungen|

дизайнерская мебель для гостиной в современном стиле дизайнерская мебель для гостиной в современном стиле .

пленка самоклеющаяся для наружного применения samokleyushchayasya-plenka-1.ru .

пленка венге для мебели http://samokleyushchayasya-plenka-1.ru .

стоимость дизайнерской мебели стоимость дизайнерской мебели .

дизайнерская мебель петербург дизайнерская мебель петербург .

https://chasinglight.in/

комплексное продвижение сайтов москва комплексное продвижение сайтов москва .

интернет продвижение москва https://poiskovoe-seo-v-moskve.ru/ .

https://rafting-morvan-passion.fr/

статьи про seo статьи про seo .

статьи про продвижение сайтов статьи про продвижение сайтов .

оптимизация сайта блог оптимизация сайта блог .

дом под ключ stroitelstvo-domov-irkutsk-2.ru .

наркологическая больница http://narkologicheskaya-klinika-12.ru/ .

наркология анонимно http://narkologicheskaya-klinika-11.ru/ .

оптимизация сайта блог https://www.statyi-o-marketinge1.ru .

I’m not sure exactly why but this weblog is loading extremely slow for me. Is anyone else having this issue or is it a issue on my end? I’ll check back later and see if the problem still exists.

kra39 cc

наркологический частный центр https://narkologicheskaya-klinika-13.ru .

наркологическая служба narkologicheskaya-klinika-14.ru .

Can you tell us more about this? I’d want to find out more details.

кракен маркетплейс

статьи про продвижение сайтов статьи про продвижение сайтов .

учиться seo http://www.kursy-seo-1.ru .

продвижение обучение https://kursy-seo-3.ru/ .

seo базовый курc http://www.kursy-seo-4.ru .

seo интенсив http://www.kursy-seo-2.ru .

plane money game aviator-igra-2.ru .

авиатор казино авиатор казино .

Why visitors still use to read news papers when in this technological globe the whole thing is presented on net?

https://kra39at.org/

aviator money game http://aviator-igra-5.ru/ .

где найти игру авиатор на деньги https://www.aviator-igra-4.ru .

фабрика шитья одежды http://nitkapro.ru/ .

перепланировка и согласование https://soglasovanie-pereplanirovki-kvartiry17.ru .

заказать проект перепланировки москва http://proekt-pereplanirovki-kvartiry9.ru/ .

карнизы для штор купить в москве http://elektrokarnizy5.ru .

1xbet авиатор 1xbet авиатор .

https://bar-vip.ru/vyezdnoi_bar/

https://peterburg2.ru/

Just wish to say your article is as astonishing. The clearness in your post is just nice and i can assume you’re an expert on this subject. Fine with your permission let me to grab your feed to keep up to date with forthcoming post. Thanks a million and please continue the rewarding work.

https://lkra39.at/

Привет!

Почему отпуск не помогает, а понедельник снова превращается в ад. [url=https://zhit-legche.ru/emoczionalnoe-vygoranie/]эмоциональное выгорание тест [/url] Разбираемся с корнями проблемы.

Переходи: – https://zhit-legche.ru/emoczionalnoe-vygoranie/

тест на эмоциональное выгорание

тест на выгорание

выгорание как вернуть себе энергию

Пока!

https://push-network-rankings.com/

слот авиатор https://www.aviator-igra-2.ru .

https://www.te-in.ru/

Vzrušující svět online casino cz — Průvodce pro české hráče: online casino cz

aviator играть на деньги http://aviator-igra-3.ru .

https://hr.rivagroup.su/

Jako žurnalista vím, že klíčem je text, který sluší čtenáři, obsahuje jednoduchá slova, srozumitelný styl a praktické informace, zvlášť když jde o „cz casino online“ a „kasina“. Tady je vaše nové, svěží a užitečné čtení: cz casino online

Wow, fantastic blog structure! How long have you been running a blog for? you made blogging look easy. The total look of your site is magnificent, let alone the content material!

https://decorator.net.ua/chomu-ne-vsi-led-lampy-sumisni-zi-sklom-far.html

Pokud hledáte online casino cz, cz casino online nebo kasina, jste na správném místě. Jsem žurnalista a pomohu vám srovnat rizika i možnosti českého online hazardu – stylově, seriózně a uživatelsky přívětivě: online casino cz

Hey I am so happy I found your webpage, I really found you by accident, while I was browsing on Google for something else, Anyways I am here now and would just like to say kudos for a marvelous post and a all round enjoyable blog (I also love the theme/design), I don’t have time to read through it all at the minute but I have bookmarked it and also added in your RSS feeds, so when I have time I will be back to read more, Please do keep up the fantastic jo.

kra39 at

проектирование перепланировки http://www.soglasovanie-pereplanirovki-kvartiry17.ru .

Join kubet’s Instagram for real-time announcements, giveaways, and community engagement

Здравствуйте!

Заработок на скинах CS2: мифы и реальность. [url=https://zarabotok-na-igrah.ru/prodat-skiny/]как продать скины в кс 2 [/url] Честный рассказ о том, сколько можно поднять на торговле.

Написал: – https://zarabotok-na-igrah.ru/prodat-skiny/

продать скины cs2

как продать скины в кс 2

продать скин

Пока!

mostbet 30fs

https://russpain.com/

кондиционеры цена кондиционеры цена .

https://flatinn.ru/ru/moscow/shelepixa-2936/

кондиционер под ключ цена обнинск кондиционер под ключ цена обнинск .

стоимость работы натяжного потолка стоимость работы натяжного потолка .

натяжные потолки липецк натяжные потолки липецк .

Мы гарантируем корректность оформления документов и соблюдение сроков поставки груза: таможенный брокер в Москве

Наша платформа https://probilets.com/ работает круглосуточно и не знает слова перерыв. Бронировать и планировать можно где угодно: в поезде, на даче, в кафе или лежа на диване. Хотите купить билет, пока идёте по супермаркету? Просто достаньте телефон и оформите поездку. Нужно скорректировать планы, отменить или перенести билет? Это тоже можно сделать онлайн, без звонков и визитов. Но если возникла проблема, то наши специалисты помогут и все расскажут

https://bpr-work.ru/

https://telegium.com/advertisement/137846/

Rainbet Australia

где купить диплом с занесением реестр где купить диплом с занесением реестр .

где купить аттестат о среднем образовании где купить аттестат о среднем образовании .

Купить диплом колледжа в Севастополь Купить диплом колледжа в Севастополь .

Мы готовы предложить документы любых учебных заведений, расположенных в любом регионе РФ. Заказать диплом любого ВУЗа:

купить аттестат 11 класс рб

купить диплом проведенный купить диплом проведенный .

Заказать диплом любого ВУЗа!

Наша компания предлагаетвыгодно приобрести диплом, который выполняется на бланке ГОЗНАКа и заверен мокрыми печатями, штампами, подписями должностных лиц. Диплом пройдет любые проверки, даже с применением специальных приборов. Решайте свои задачи быстро с нашим сервисом- perekrestok.flybb.ru/posting.php?mode=post&f=2

диплом купить с проводкой диплом купить с проводкой .

купить диплом о среднем специальном купить диплом о среднем специальном .

купить диплом о высшем образовании специалиста купить диплом о высшем образовании специалиста .

купить диплом специалиста дешево купить диплом специалиста дешево .

купить аттестат 11 класса 2016 купить аттестат 11 класса 2016 .

купить аттестат об окончании 11 классов купить аттестат об окончании 11 классов .

Заказать диплом университета мы поможем. Купить диплом специалиста в Курске – diplomybox.com/kupit-diplom-spetsialista-v-kurske

Приобрести диплом можно через официальный портал компании. skvortsy.listbb.ru/viewtopic.php?f=31&t=3535

купить диплом проведенный купить диплом проведенный .

купить настоящий диплом киев http://www.educ-ua16.ru .

купить диплом с занесением в реестр цена купить диплом с занесением в реестр цена .

купить диплом с регистрацией купить диплом с регистрацией .

диплом автотранспортного техникума купить диплом автотранспортного техникума купить .

купить диплом о среднем специальном образовании цена купить диплом о среднем специальном образовании цена .

Мы изготавливаем дипломы любой профессии по выгодным ценам. Покупка документа, подтверждающего окончание университета, – это выгодное решение. Приобрести диплом университета: mcsold.ca/agents/lenawyrick8360

купить диплом в кривом роге купить диплом в кривом роге .

Мы изготавливаем дипломы любых профессий по приятным тарифам. Купить диплом Новочеркасск — kyc-diplom.com/geography/novocherkassk.html

В поисках самых свежих трейлеров фильмов 2026 и трейлеров 2026 на русском? Наш портал — это место, где собираются лучшие трейлеры сериалов 2026. Здесь вы можете смотреть трейлер бесплатно в хорошем качестве, будь то громкая премьера лорд трейлер или долгожданный трейлер 3 сезона вашего любимого сериала. Мы тщательно отбираем видео, чтобы вы могли смотреть трейлеры онлайн без спойлеров и в отличном разрешении. Всю коллекцию вы найдете по ссылке ниже: https://lordtrailer.ru/

Приобрести диплом об образовании!

Мы изготавливаем дипломы любой профессии по приятным тарифам— rossianin.ru

Rainbet Casino

https://vgarderobe.ru/zhenskie-ukorochennye-pidzhaki-vivance-bc-5645.html

https://ege-na-5.ru/

buy mdma prague buy coke in prague

Мы готовы предложить документы институтов, расположенных на территории всей России. Купить диплом университета:

купить аттестат об окончании 11

купить диплом с проводкой купить диплом с проводкой .

buy drugs in prague https://cocaine-prague-shop.com

pure cocaine in prague https://prague-coca-shop.site

стильные горшки https://dizaynerskie-kashpo-nsk.ru/ .

куплю диплом кандидата наук куплю диплом кандидата наук .

купить диплом в глазове купить диплом в глазове .

купить диплом в ревде купить диплом в ревде .

купить диплом во всеволожске rudik-diplom10.ru .

buy drugs in prague buy cocaine prague

как сделать накрутку подписчиков в тг

Акции и бонусы CS2

https://xn--krken23-bn4c.com

купить диплом в кургане занесением в реестр купить диплом в кургане занесением в реестр .

диплом купить с занесением в реестр рязань http://frei-diplom2.ru/ .

кто купил диплом с занесением в реестр кто купил диплом с занесением в реестр .

купить диплом о высшем образовании с занесением в реестр в москве купить диплом о высшем образовании с занесением в реестр в москве .

купить диплом физика купить диплом физика .

купить медицинский диплом с занесением в реестр купить медицинский диплом с занесением в реестр .

купить диплом техникума образец пять плюс купить диплом техникума образец пять плюс .

купить диплом в сыктывкаре купить диплом в сыктывкаре .

купить диплом логопеда купить диплом логопеда .

купить диплом в химках купить диплом в химках .

купить диплом в анапе rudik-diplom2.ru – купить диплом в анапе .

купить диплом в кызыле купить диплом в кызыле .

купить диплом в выборге https://www.rudik-diplom14.ru .

купить диплом бакалавра купить диплом бакалавра .

купить диплом техникума об окончании купить диплом техникума об окончании .

медсестра которая купила диплом врача медсестра которая купила диплом врача .

Купить диплом колледжа в Луганск http://www.educ-ua7.ru .

накрутка подписчиков в тг канал

диплом колледжа купить в спб https://frei-diplom11.ru/ .

можно ли в техникуме купить диплом [url=frei-diplom7.ru]можно ли в техникуме купить диплом[/url] .

купить диплом медсестры купить диплом медсестры .

Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say excellent blog!

casino sites

как накрутить подписчиков в тг канал ботов

накрутка подписчиков в телеграм канал бесплатно

Надпись на футболке на спине и надписи на футболках с фото в Кемерово. Перчатки сенсорные эластичные белые и вязаные шапки оптом в Иваново. Сделать самим футболку с принтом и футболка оверсайз на заказ в Волгограде. Какими нитками вышивают на одежде и пластиковая подарочная упаковка в Сургуте. Надписи на футболках оптом с рисунками и надписи на футболках на английском: печать на футболке нанесение на футболки оптом

накрутка подписчиков в тг платно

накрутка настоящих подписчиков в телеграм

щетки

накрутить живых подписчиков в телеграм

цветочные горшки дизайнерские купить http://www.dizaynerskie-kashpo-rnd.ru/ .

подписчики в тг канал

https://www.restate.ru/

купить диплом в бору http://rudik-diplom12.ru .

Таможенный брокер в Москве — это гарантия правильного заполнения деклараций и соблюдения всех норм законодательства: таможенный брокер

https://garantstroikompleks.ru/

купить диплом в стерлитамаке https://www.rudik-diplom2.ru – купить диплом в стерлитамаке .

купить диплом электрика купить диплом электрика .

мед оборудование http://www.medicinskoe-oborudovanie-213.ru .

оборудование для больниц http://www.medicinskoe-oborudovanie-77.ru/ .

лучшие займы онлайн лучшие займы онлайн .

курсы по seo курсы по seo .

медицинское оборудование медицинское оборудование .

мфо займ мфо займ .

займы всем http://www.zaimy-50.ru .

накрутка активных подписчиков в тг канал

накрутить живых подписчиков в телеграм

https://pgu32.ru/

легальный диплом купить легальный диплом купить .

купить диплом экономиста купить диплом экономиста .

купить диплом в твери купить диплом в твери .

накрутка подписчиков в телеграм канал без отписок

купить диплом в самаре купить диплом в самаре .

купить диплом в мурманске купить диплом в мурманске .

купить диплом вуза купить диплом вуза .

купить диплом педагога http://rudik-diplom2.ru – купить диплом педагога .

диплом колледжа купить спб https://frei-diplom10.ru/ .

диплом техникума колледжа купить пять плюс диплом техникума колледжа купить пять плюс .

накрутка подписчиков в телеграм канал живых

s1.piratehub.biz – лучшая база курсов на каждый день

диплом об окончании колледжа купить в http://www.frei-diplom11.ru .

диплом реестр купить диплом реестр купить .

купить диплом с реестром купить диплом с реестром .

купить диплом в симферополе http://www.rudik-diplom1.ru .

купить диплом ташкентского техникума купить диплом ташкентского техникума .

медсестра которая купила диплом врача https://www.frei-diplom13.ru .

микро займы онлайн микро займы онлайн .

как заказать алкоголь через интернет с доставкой https://alcohub9.ru .

купить диплом повара-кондитера купить диплом повара-кондитера .

Kingpin Crown in Australia is a premium entertainment venue offering bowling, laser tag, arcade games, karaoke, and dining: Kingpin Crown FAQs

сайт для накрутки подписчиков в телеграм

https://altegs.ru/

накрутка подписчиков телеграм канал купить

проект водопонижения скважинами проект водопонижения скважинами .

проект водопонижения котлована в грунтовых водах vodoponizhenie-proekt.ru .

Crown Metropol Perth is a luxury hotel located near the Swan River. It offers modern rooms, a stunning pool area, fine dining, a casino, and entertainment options: Crown Metropol Perth location

Слив курсов https://www.sliv.fun .

https://rd-ok.ru/

разработка проекта водопонижения https://proekt-na-vodoponizhenie.ru .

купить накрутку подписчиков в тг

современное медицинское оборудование https://www.medoborudovanie-msk.ru .

разработка проекта водопонижения http://www.proekt-na-vodoponijenie.ru .

https://kitehurghada.ru/

проект водопонижения скважинами https://proekt-vodoponizheniya.ru .

заказать алкоголь круглосуточно http://www.alcohub9.ru/ .

поставщик медоборудования https://www.medoborudovanie-russia.ru .

https://accountingreform.ru/

купить подписчиков в телеграме

buy angular contact ball bearing Buy Ball Bearings When it comes to purchasing ball bearings, it’s essential to choose the right supplier to ensure that you receive quality products. Our platform makes it easy to buy ball bearings online. We provide detailed product descriptions, specifications, and customer reviews to help you make informed decisions. Whether you need a single ball bearing or bulk quantities, we can accommodate your order. Enjoy hassle-free shopping and swift delivery when you buy ball bearings from us.

медоборудование медоборудование .

проектирование глубинного водопонижения http://www.vodoponizhenie-proekt.ru .

buy mdma prague buy xtc prague

plug in prague buy coke in prague

накрутка подписчиков в тг бесплатно без регистрации

https://fixme.com.ua/

монтаж котлов отопления монтаж котлов отопления .

проект водопонижения эжекторными иглофильтрами https://proekt-na-vodoponijenie.ru/ .

медицинские приборы http://www.medoborudovanie-msk.ru .

накрутка подписчиков телеграм без заданий

https://fixme.com.ua/

мед оборудование мед оборудование .

горшок автополив http://www.kashpo-s-avtopolivom-spb.ru/ .

исторические фильмы исторические фильмы .

сериалы тнт онлайн https://www.kinogo-15.top .

где купить подписчиков в телеграм канал

high RTP slot games

Девушка приехала быстро, выглядела сногсшибательно, а ее массаж был просто огнем, обязательно повторю. Крайне рекомендую, эротический массаж вызвать Новосибирск – https://sibirki3.vip/. Обязательно повторю, всё понравилось.

купить диплом в ачинске купить диплом в ачинске .

купить диплом в чите купить диплом в чите .

Заботьтесь о здоровье сосудов ног с профессионалом! В группе «Заметки практикующего врача-флеболога» вы узнаете всё о профилактике варикоза, современных методиках лечения (склеротерапия, ЭВЛО), УЗИ вен и точной диагностике. Доверяйте опытному врачу — ваши ноги заслуживают лучшего: эвло

Нужна презентация? генератор презентаций по файлу Создавайте убедительные презентации за минуты. Умный генератор формирует структуру, дизайн и иллюстрации из вашего текста. Библиотека шаблонов, фирстиль, графики, экспорт PPTX/PDF, совместная работа и комментарии — всё в одном сервисе.

все онлайн займы http://zaimy-12.ru .

займы онлайн займы онлайн .

купить телефон спб kupit-telefon-samsung-1.ru .

apple airpods max 2 https://naushniki-apple-1.ru/ .

купить подписчиков в телеграм без отписок

https://device-rf.ru/catalog/iphone/

https://plenka-okna.ru/

все займы все займы .

займ всем займ всем .

сколько стоит купить диплом медсестры сколько стоит купить диплом медсестры .

накрутка активных подписчиков в телеграм канал

купить диплом моториста купить диплом моториста .

купить диплом в самаре купить диплом в самаре .

прямой эфир это http://www.zakazat-onlayn-translyaciyu.ru/ .

https://www.wildberries.ru/catalog/183263596/detail.aspx

список займов онлайн на карту http://www.zaimy-25.ru .

купить диплом с проводкой одно купить диплом с проводкой одно .

купить смартфон самсунг в спб купить смартфон самсунг в спб .

организация онлайн трансляции конференции zakazat-onlayn-translyaciyu1.ru .

реквизит и свет для подкастов https://www.studiya-podkastov-spb.ru .

купить диплом в буйнакске http://www.rudik-diplom10.ru .

изготовление значков на заказ москва производство металлических значков

интернет магазин телефонов самсунг kupit-telefon-samsung-1.ru .

airpods max купить спб https://www.naushniki-apple-1.ru .

An outstanding share! I have just forwarded this onto a coworker who had been conducting a little homework on this. And he actually ordered me lunch simply because I stumbled upon it for him… lol. So let me reword this…. Thanks for the meal!! But yeah, thanks for spending the time to talk about this topic here on your web site.

официальный сайт kra40.at

запись подкастов студия запись подкастов студия .