E-Invoice & Dynamic QR Code — Master Summary

E-Invoice & Dynamic QR Code — Master Summary

All rules, thresholds, exemptions, penalties, latest advisory and more, packed in ONE place!

E-INVOICE AND DYNAMIC QR CODE UNDER GST – MASTER SUMMARY!!

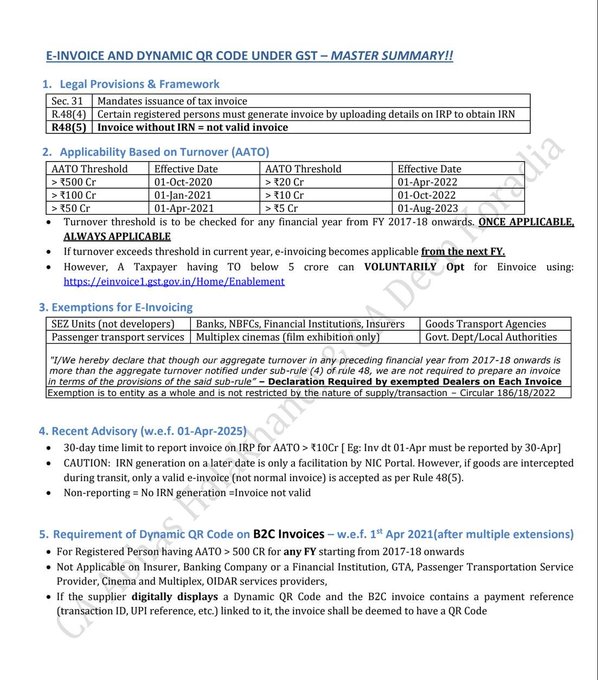

1. Legal Provisions & Framework

| Sec. 31 | Mandates issuance of tax invoice |

| R.48(4) | Certain registered persons must generate invoice by uploading details on IRP to obtain IRN |

| R48(5) | Invoice without IRN = not valid invoice |

2. Applicability Based on Turnover (AATO)

| AATO Threshold | Effective Date | AATO Threshold | Effective Date |

| > ₹500 Cr | 01-Oct-2020 | > ₹20 Cr | 01-Apr-2022 |

| > ₹100 Cr | 01-Jan-2021 | > ₹10 Cr | 01-Oct-2022 |

| > ₹50 Cr | 01-Apr-2021 | > ₹5 Cr | 01-Aug-2023 |

- Turnover threshold is to be checked for any financial year from FY 2017-18 onwards. ONCE APPLICABLE, ALWAYS APPLICABLE

- If turnover exceeds threshold in current year, e-invoicing becomes applicable from the next FY.

- However, A Taxpayer having TO below 5 crore can VOLUNTARILY Opt for Einvoice using: https://einvoice1.gst.gov.in/Home/Enablement

3. Exemptions for E-Invoicing

| SEZ Units (not developers) | Banks, NBFCs, Financial Institutions, Insurers | Goods Transport Agencies |

| Passenger transport services | Multiplex cinemas (film exhibition only) | Govt. Dept/Local Authorities |

“I/We hereby declare that though our aggregate turnover in any preceding financial year from 2017-18 onwards is more than the aggregate turnover notified under sub-rule (4) of rule 48, we are not required to prepare an invoice in terms of the provisions of the said sub-rule” – Declaration Required by exempted Dealers on Each Invoice |

||

Exemption is to entity as a whole and is not restricted by the nature of supply/transaction – Circular 186/18/2022 |

||

4. Recent Advisory (w.e.f. 01-Apr-2025)

- 30-day time limit to report invoice on IRP for AATO > ₹10Cr [ Eg: Inv dt 01-Apr must be reported by 30-Apr]

- CAUTION: IRN generation on a later date is only a facilitation by NIC Portal. However, if goods are intercepted during transit, only a valid e-invoice (not normal invoice) is accepted as per Rule 48(5).

- Non-reporting = No IRN generation =Invoice not valid

5. Requirement of Dynamic QR Code on B2C Invoices – w.e.f. 1st Apr 2021(after multiple extensions)

- For Registered Person having AATO > 500 CR for any FY starting from 2017-18 onwards

- Not Applicable on Insurer, Banking Company or a Financial Institution, GTA, Passenger Transportation Service Provider, Cinema and Multiplex, OIDAR services providers,

- If the supplier digitally displays a Dynamic QR Code and the B2C invoice contains a payment reference (transaction ID, UPI reference, etc.) linked to it, the invoice shall be deemed to have a QR Code

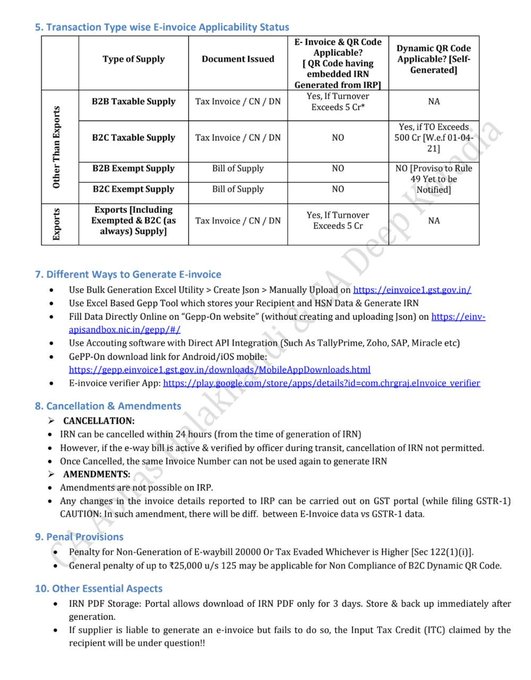

5. Transaction Type wise E-invoice Applicability Status

| Type of Supply | Document Issued | E- Invoice & QR Code Applicable?

[ QR Code having embedded IRN Generated from IRP] |

Dynamic QR Code Applicable? [Self-Generated] | |

| Other Than Exports | B2B Taxable Supply | Tax Invoice / CN / DN | Yes, If Turnover Exceeds 5 Cr* | NA |

| B2C Taxable Supply | Tax Invoice / CN / DN | NO | Yes, if TO Exceeds 500 Cr [W.e.f 01-04-21] | |

| B2B Exempt Supply | Bill of Supply | NO | NO [Proviso to Rule 49 Yet to be Notified] | |

| B2C Exempt Supply | Bill of Supply | NO | ||

| Exports | Exports [Including Exempted & B2C (as always) Supply] | Tax Invoice / CN / DN | Yes, If Turnover Exceeds 5 Cr | NA |

7. Different Ways to Generate E-invoice

- Use Bulk Generation Excel Utility > Create Json > Manually Upload on https://einvoice1.gst.gov.in/

- Use Excel Based Gepp Tool which stores your Recipient and HSN Data & Generate IRN

- Fill Data Directly Online on “Gepp-On website” (without creating and uploading Json) on https://einv-apisandbox.nic.in/gepp/#/

- Use Accouting software with Direct API Integration (Such As TallyPrime, Zoho, SAP, Miracle etc)

- GePP-On download link for Android/iOS mobile: https://gepp.einvoice1.gst.gov.in/downloads/MobileAppDownloads.html

- E-invoice verifier App: https://play.google.com/store/apps/details?id=com.chrgraj.eInvoice_verifier

8. Cancellation & Amendments

- CANCELLATION:

- IRN can be cancelled within 24 hours (from the time of generation of IRN)

- However, if the e-way bill is active & verified by officer during transit, cancellation of IRN not permitted.

- Once Cancelled, the same Invoice Number can not be used again to generate IRN

- AMENDMENTS:

- Amendments are not possible on IRP.

- Any changes in the invoice details reported to IRP can be carried out on GST portal (while filing GSTR-1) CAUTION: In such amendment, there will be diff. between E-Invoice data vs GSTR-1 data.

9. Penal Provisions

- Penalty for Non-Generation of E-waybill 20000 Or Tax Evaded Whichever is Higher [Sec 122(1)(i)].

- General penalty of up to ₹25,000 u/s 125 may be applicable for Non Compliance of B2C Dynamic QR Code.

10. Other Essential Aspects

- IRN PDF Storage: Portal allows download of IRN PDF only for 3 days. Store & back up immediately after generation.

- If supplier is liable to generate an e-invoice but fails to do so, the Input Tax Credit (ITC) claimed by the recipient will be under question!!

Link to PDF bit.ly/E-Invoice-Summ

20 comments

amoxicillin pills – https://combamoxi.com/ amoxil pill

amoxicillin tablet – comba moxi buy amoxil pill

cheap amoxicillin generic – cheap amoxil pills buy amoxil pills for sale

buy amoxicillin online cheap – combamoxi buy amoxicillin generic

https://altclasses.in/

amoxicillin over the counter – combamoxi.com amoxil uk

кашпо напольное пластик купить https://kashpo-napolnoe-rnd.ru – кашпо напольное пластик купить .

order cenforce generic – cenforce generic cenforce online

cialis online without prescription – https://ciltadgn.com/ cialis sublingual

tadalafil 5 mg tablet – https://strongtadafl.com/ where to buy cialis online for cheap

zantac 150mg ca – zantac 300mg over the counter buy zantac no prescription

I am in fact happy to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. accutane prospecto

This is the big-hearted of criticism I rightly appreciate. https://buyfastonl.com/furosemide.html

The thoroughness in this piece is noteworthy. https://ursxdol.com/cialis-tadalafil-20/

This is the description of glad I enjoy reading. https://aranitidine.com/fr/cialis-super-active/

More posts like this would bring about the blogosphere more useful.

plavix order

Palatable blog you possess here.. It’s severely to espy high quality article like yours these days. I justifiably comprehend individuals like you! Take mindfulness!! https://experthax.com/forum/member.php?action=profile&uid=124577

Thanks for sharing. It’s acme quality. https://experthax.com/forum/member.php?action=profile&uid=124793

Купить диплом колледжа в Запорожье Купить диплом колледжа в Запорожье .

диплом техникума купить форум http://www.educ-ua9.ru .