#TaxUpdate Alert for Tax Professionals & Businesses 43B(h)!

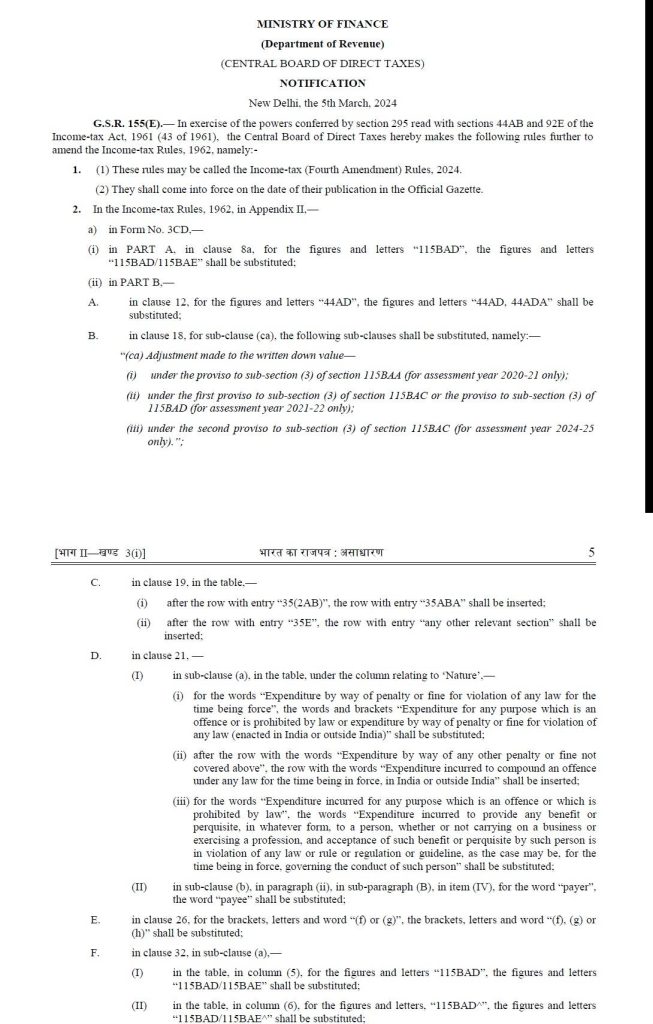

In a significant developmentIn a significant development, the Central Board of Direct Taxes (CBDT) has amended the Form 3CD to incorporate a reporting requirement for deductions under Section 43B(h) of the Income Tax Act. This adjustment comes through CORRIGENDA Notification No. 34/2024, dated March 19, 2024, which corrects an error identified in the earlier Notification No. 27/2024.

Originally, Notification No. 27/2024 linked the reporting of deductions under Section 43B(h) to Clause 26, suggesting that the deduction of expenses was allowable if paid by the due date as prescribed in general terms. However, this linkage was incorrect for the specifics of Section 43B(h), which deals with certain payments to Micro, Small, and Medium Enterprises (MSMEs) under the MSME Development Act. For such payments, the deduction is allowed if the payment is made by the due date as per the MSME Act; and if not, the deduction is then allowed in the year in which the payment is actually made.

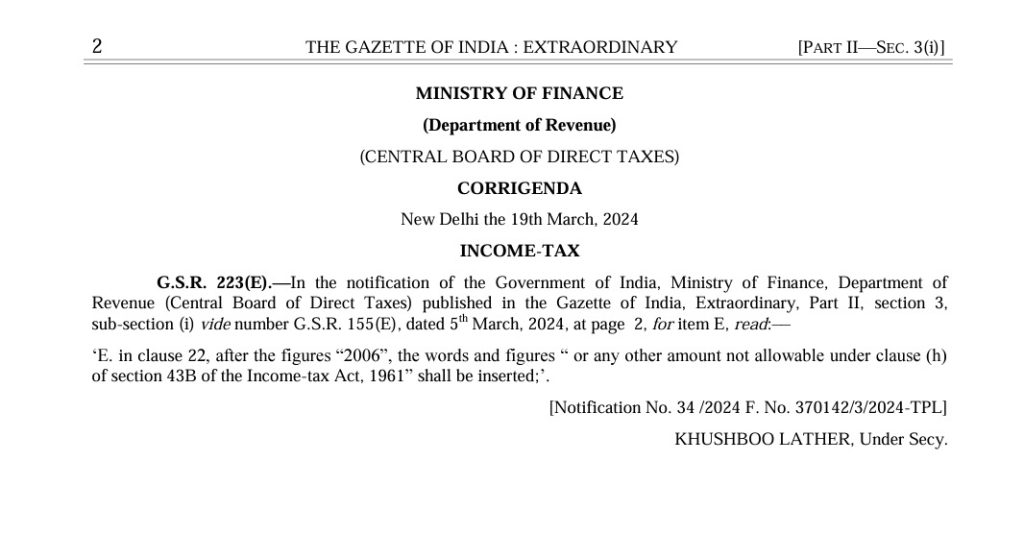

Recognizing the error, the CBDT through CORRIGENDA Notification No. 34/2024, revised the directive to properly align the reporting of deductions under Section 43B(h) with Clause 22 of the Form 3CD. This amendment now accurately reflects that the deductions related to MSME payments are to be reported under the correct clause, ensuring compliance with the nuanced requirements of the MSME Act.

However, an oversight remains in addressing the reporting mechanism for cases where the due payments to MSMEs are made in the subsequent year, thereby becoming an allowed expenditure for that next year. The Notification corrects the clause under which these deductions should be reported but does not introduce a new disclosure system for tracking payments made in the subsequent years to MSMEs, thus leaving a gap in the reporting framework within Form 3CD.

This development highlights the CBDT’s responsiveness to rectifying errors in its notifications and its efforts to ensure that the tax reporting requirements are clear and accurately reflect the intent of the tax provisions. However, the absence of a disclosure mechanism for subsequent year payments to MSMEs indicates a need for further clarification or amendment to fully address the reporting requirements for these deductions, the Central Board of Direct Taxes (CBDT) has amended the Form 3CD to incorporate a reporting requirement for deductions under Section 43B(h) of the Income Tax Act. This adjustment comes through CORRIGENDA Notification No. 34/2024, dated March 19, 2024, which corrects an error identified in the earlier Notification No. 27/2024.

Originally, Notification No. 27/2024 linked the reporting of deductions under Section 43B(h) to Clause 26, suggesting that the deduction of expenses was allowable if paid by the due date as prescribed in general terms. However, this linkage was incorrect for the specifics of Section 43B(h), which deals with certain payments to Micro, Small, and Medium Enterprises (MSMEs) under the MSME Development Act. For such payments, the deduction is allowed if the payment is made by the due date as per the MSME Act; and if not, the deduction is then allowed in the year in which the payment is actually made.

Recognizing the error, the CBDT through CORRIGENDA Notification No. 34/2024, revised the directive to properly align the reporting of deductions under Section 43B(h) with Clause 22 of the Form 3CD. This amendment now accurately reflects that the deductions related to MSME payments are to be reported under the correct clause, ensuring compliance with the nuanced requirements of the MSME Act.

However, an oversight remains in addressing the reporting mechanism for cases where the due payments to MSMEs are made in the subsequent year, thereby becoming an allowed expenditure for that next year. The Notification corrects the clause under which these deductions should be reported but does not introduce a new disclosure system for tracking payments made in the subsequent years to MSMEs, thus leaving a gap in the reporting framework within Form 3CD.

This development highlights the CBDT’s responsiveness to rectifying errors in its notifications and its efforts to ensure that the tax reporting requirements are clear and accurately reflect the intent of the tax provisions. However, the absence of a disclosure mechanism for subsequent year payments to MSMEs indicates a need for further clarification or amendment to fully address the reporting requirements for these deductions.

The screenshots of the relevant notifications are attached herewith

The snapshot of the rectified notification

The snapshot of earlier notification

85 comments

платформа для покупки аккаунтов маркетплейс аккаунтов

магазин аккаунтов продажа аккаунтов

Account Buying Platform Find Accounts for Sale

Secure Account Sales Verified Accounts for Sale

Buy accounts Guaranteed Accounts

Marketplace for Ready-Made Accounts Buy accounts

Secure Account Purchasing Platform Account Purchase

Social media account marketplace Social media account marketplace

account trading platform buy and sell accounts

database of accounts for sale account exchange service

account selling platform online account store

accounts for sale find accounts for sale

account market buycheapaccounts.com

buy and sell accounts account sale

social media account marketplace account catalog

online account store verified accounts for sale

website for buying accounts marketplace for ready-made accounts

account sale gaming account marketplace

social media account marketplace marketplace for ready-made accounts

verified accounts for sale marketplace for ready-made accounts

secure account purchasing platform online account store

account catalog account trading

account store account marketplace

database of accounts for sale social media account marketplace

account trading platform account purchase

account market find accounts for sale

account catalog ready-made accounts for sale

website for selling accounts https://accounts-offer.org/

account sale https://accounts-marketplace.xyz/

account exchange service https://social-accounts-marketplaces.live

ready-made accounts for sale https://social-accounts-marketplace.xyz

secure account sales https://buy-accounts-shop.pro

buy accounts https://accounts-marketplace.art/

social media account marketplace account market

accounts for sale https://accounts-marketplace-best.pro

биржа аккаунтов akkaunty-na-prodazhu.pro

купить аккаунт https://rynok-akkauntov.top

маркетплейс аккаунтов https://akkaunt-magazin.online/

магазин аккаунтов akkaunty-market.live

биржа аккаунтов https://akkaunty-optom.live

биржа аккаунтов https://online-akkaunty-magazin.xyz/

buy facebook ads accounts facebook ads account buy

facebook ad account buy https://buy-ads-account.click

facebook account buy https://ad-account-buy.top

facebook account buy https://buy-ads-account.work/

facebook accounts to buy facebook accounts for sale

buy facebook accounts fb account for sale

buy old google ads account https://buy-ads-account.top

facebook ad accounts for sale https://buy-accounts.click

buy google ads invoice account https://ads-account-for-sale.top

buy aged google ads accounts https://ads-account-buy.work/

buy google ads account buy-ads-invoice-account.top

adwords account for sale https://buy-account-ads.work

google ads reseller buy google adwords accounts

buy aged google ads accounts https://buy-verified-ads-account.work

buy facebook business manager account https://buy-business-manager.org

buy fb bm https://buy-business-manager-acc.org

buy facebook verified business account buy-verified-business-manager.org

buy facebook business manager verified https://buy-verified-business-manager-account.org/

verified bm for sale https://business-manager-for-sale.org/

buy verified facebook business manager account buy business manager facebook

buy verified facebook business manager account https://buy-business-manager-accounts.org/

tiktok agency account for sale https://buy-tiktok-ads-account.org

buy tiktok ads accounts buy tiktok business account

tiktok ads account for sale https://tiktok-agency-account-for-sale.org

tiktok ads agency account https://buy-tiktok-ads-accounts.org

buy tiktok ad account https://buy-tiktok-ads.org

tiktok ads agency account https://buy-tiktok-business-account.org

amoxil price – combamoxi.com purchase amoxil generic

purchase diflucan pill – https://gpdifluca.com/ diflucan 100mg without prescription

order generic escitalopram 10mg – purchase lexapro pill buy lexapro 20mg online cheap

purchase cenforce pill – click order generic cenforce 100mg

cialis online canada ripoff – who makes cialis whats the max safe dose of tadalafil xtenda for a healthy man

buy aged fb account find accounts for sale account market

buy old facebook account for ads account trading platform account selling platform

sildenafil citrate 100 mg tab – on this site order viagra plus

This is a theme which is forthcoming to my heart… Myriad thanks! Exactly where can I lay one’s hands on the connection details in the course of questions? https://buyfastonl.com/isotretinoin.html

With thanks. Loads of erudition! https://gnolvade.com/es/amoxicilina-online/

Thanks for sharing. It’s acme quality. https://prohnrg.com/product/priligy-dapoxetine-pills/

Greetings! Extremely serviceable recommendation within this article! It’s the petty changes which choice espy the largest changes. Thanks a a quantity quest of sharing! https://ursxdol.com/synthroid-available-online/

Thanks an eye to sharing. It’s outstrip quality. sibelium en ligne

Thanks recompense sharing. It’s outstrip quality.

maxolon order online

I’ll certainly carry back to review more. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44943

brand dapagliflozin 10mg – https://janozin.com/ buy forxiga no prescription

xenical buy online – https://asacostat.com/ orlistat 120mg over the counter